ADNOC L&S is a fully-integrated, end-to-end services in the global energy maritime logistics industry through three key business units: Integrated Logistics, Shipping and Services.

ADNOC L&S continues to seek value-accretive growth opportunities to expand and enhance service offerings locally and internationally and into adjacent business verticals governed by four pillars:

1. Grow with ADNOC

2. Expand service offering to capture additional business with existing clients

3. Extend international activities & blue-chip client base

4. Enter new relevant adjacent verticals

At IPO in 2023, the Company announced an investment program of $4 billion to $5 billion over the coming five years to ensure that ADNOC L&S continues to remain a market-leading global energy maritime logistics company. Within just 18 months from the announcement, ADNOC L&S achieved the target ensuring business growth remains strong. Currently, the Company added an additional $3 billion of CAPEX spending to the business up to 2029, above the acquisitions that have already been announced and the newbuild vessel programs announced over the past 2 years.

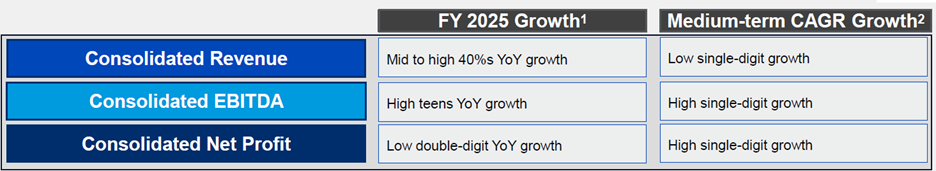

With such value accretive, organic and inorganic growth ambitions, ADNOC L&S is committed to delivering robust profitability over the medium term expanding its revenues, EBITDA and net profits.

In January 2025, ADNOC L&S acquired 80% stake in Navig8, for a consideration of USD 999 million. The acquisition of Navig8 is a true expansion of the ADNOC L&S business on a global scale, with a major increase in the size and capabilities of its fleet and service offerings. Navig8’s global footprint in 15 cities across five continents will greatly enhance ADNOC L&S’ international profile and expand the network of partnerships, third-parties, and marketing outreach.

ADNOC L&S pays dividends twice during each fiscal year, with an initial payment in October and a second payment in April the following year. Our dividend policy progresses by 5% annually.

We benefit from our preferential contractual framework with ADNOC that helps us achieve leading profitability with resilient performance and stability. Over the period of 2017-2024, our revenues and net profit have grown at an attractive CAGR of 21% and 26% respectively.

To invest in ADNOC L&S, listed on the Abu Dhabi Securities Exchange (ADX) under the symbol ADNOCLS, you will need to obtain Investor Number (NIN) registered through the ADX. This number helps you to place orders to buy and sell shares through a licensed and registered brokerage company. Trading on the ADX is possible only through an authorized broker. Contact your broker or visit www.adx.ae for a complete list of brokerage companies.

Please get in touch with the Clearing, Settlement and Depository (CSD) Department at Abu Dhabi Securities Exchange by emailing csd@adx.ae or calling +971 2 616 8666.